Auctus Metal Portfolios

Auctus Metal Portfolios’ Senior Management Team, Interviewed by Roger Hirst of Real Vision Finance

Why Invest in Precious Metals

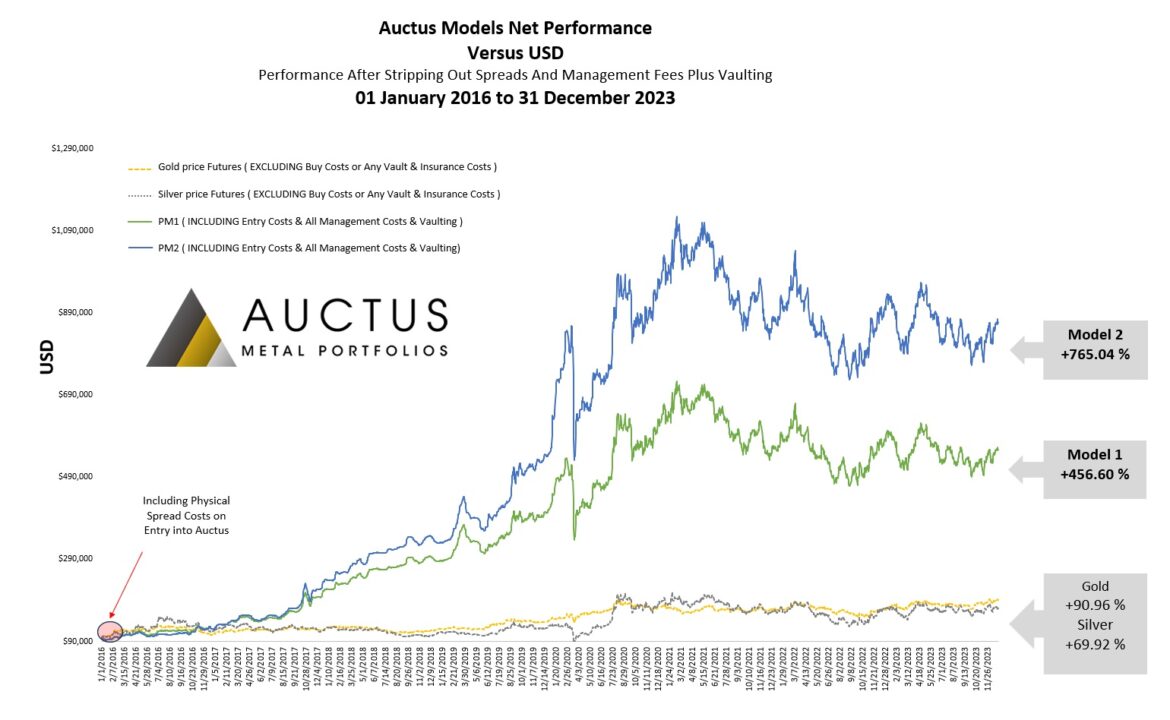

Auctus Metal Portfolios offer accredited investors the opportunity to invest into a diversified and actively managed portfolio of physical precious metals.

Auctus Metal Portfolios’ proprietary algorithms have been fully audited and verified by BDO Global and work off 55 variables. These live data feeds utilize historical price ratios, global supply-demand dynamics, implied option volatility, production price cost levels to name a few, which are then used to optimally weight and then periodically re-balance clients’ vaulted physical precious metal holdings.

This diversified and active investment strategy across Gold, Silver, Platinum, Palladium and Rhodium has historically achieved an ‘alpha return’ that has far outperformed the benchmark for Gold. As of 31 December 2023, Auctus Metal Portfolios delivered clients an annualised net compound return on investment of +30.96% from inception on 1 January 2016.

Download Auctus Metal Portfolios 2024 Investor Kit

For a Free Consultation and Account Opening Information, please visit:

www.auctusmetals.com