Rhodium is the often-overlooked member of the precious metal asset class. With a market capital close to 1% of Gold and varying taxation classifications in different global jurisdictions, it is easily and frequently put in the too hard basket by institutional investors. The rarest of the 5 major precious metals of Gold, Silver and the Platinum Group Metals (PGMs) of Platinum, Palladium and Rhodium, it has a limited range of bullion products and is most often traded in sponge form.

Despite these shortcomings in comparison to it’s more popular precious metal counterparts, it actually enjoys solid market liquidity and price transparency with multiple daily price updates on the Johnson Matthey Exchange. It also acts as an ideal diversification alternative to a portfolio of Gold and Silver when managed effectively as it regularly exhibits extreme pricing elasticity events. These events provide opportunities to significantly increase the yields of a precious metals portfolio.

Like it’s PGM counterparts of Platinum and Palladium, Rhodium is a transition metal with exceptional catalytic properties. Considered the superior element for cleaning NO2 from exhaust, its largest demand market is in catalytic convertors for the auto industry. It is within this industry where it’s interchangeability with Platinum and Palladium help develop price elasticity events. On the supply side, similar to Palladium, its mainly sourced as a by-product of platinum mining in South Africa, making it very sensitive to Platinum pricing and demand as well as geopolitical tension in that region.

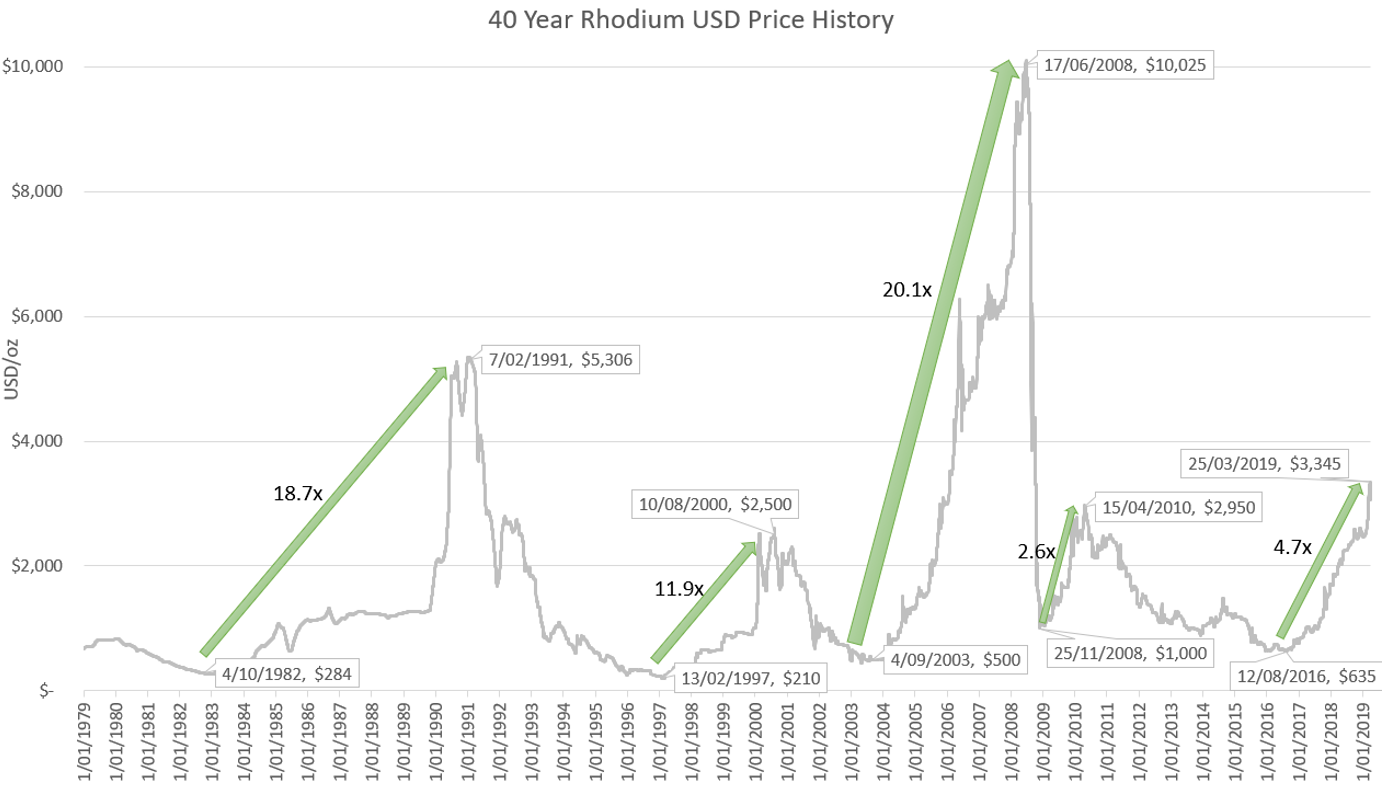

It is these intrinsic relationships with Platinum and Palladium on both the supply and demand sides which help cause regular price anomaly events over the long term. Below is a chart of USD rhodium pricing over the last 40 years.

As you can see, there have been multiple price elasticity events where Rhodium prices have seen extraordinary gains only to see them fully retrace to lower levels. With such a high risk/ high return investment product, successful rhodium trading is more about recognising when Rhodium is good value and comparatively inexpensive then waiting for an elasticity event such as it is currently experiencing. Where investors come unstuck however is in market conditions such as the present where rhodium can be seen to still have plenty of upside potential but also has equivalently as much downside risk.

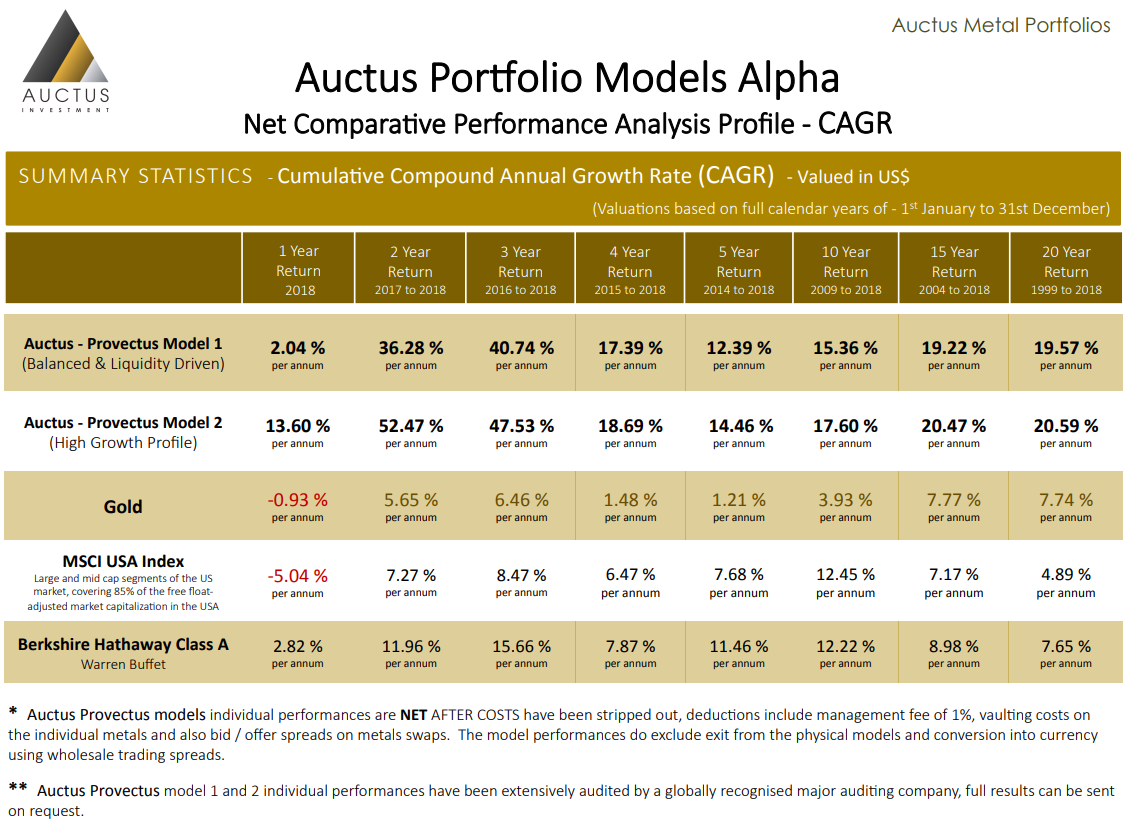

Like any successful diversified investment portfolio, it’s all about a continual balancing of potential returns with potential risk. Quantifying the appropriate exposure to these more volatile precious metals based on market conditions can significantly improve your overall precious metal investment performance. Auctus, an affiliated Singapore based company that specialises in managed physical precious metals portfolios does this very well and their long-term performance analysis results below indicate how lucrative this can be if done well by experienced precious metal market participants.

If you have any questions about Rhodium and how you can manage your precious metals portfolio better, please contact our sales team on 1300 618 363 or email [email protected]