Palladium – the quiet achiever of the Precious Metals Portfolio

Palladium – the quiet achiever of the Precious Metals Portfolio

Palladium is a metal the has flown under the radar with many precious metal investors over the last few years. The 2nd largest in market cap to platinum in the Platinum Group Metals (PGMs), it has considerably outperformed the more popular precious metals of gold, silver and platinum in recent times. Like rhodium, the 3rd major member of the PGMs, its classification in some taxation jurisdictions presents challenges to the average investor. But like any investment, these hurdles can be navigated to maximise palladium’s potential returns.

With many of the worlds top refiners producing palladium investment products, it typically shares the same denominational options of the other precious metals of gold, silver and platinum. It has very strong market liquidity and price transparency with multiple daily price updates on the Johnson Matthey Exchange. Like rhodium, its price volatility in relation to platinum and gold makes it an attractive addition to a well-managed dynamic precious metal portfolio. Below is the USD price comparison of palladium to gold and platinum over the last 3 years.

The main drivers of palladium’s strong performance in recent times relate to its industrial supply/demand dynamic. Being a transition metal with excellent catalytic properties, its primary end use is predominantly in the manufacture of catalytic converters for the auto industry. As historically it was typically priced at a discount to platinum, it became the metal of choice for petrol internal combustion engines (ICEs) catalytic conversion, despite its slightly inferior properties to platinum, whilst platinum was the metal of choice for the more demanding diesel ICE catalytic conversions. In recent years, more stringent environmental regulations have put pressure on the diesel ICE industry which has slowed down overall platinum demand. Although petrol ICEs have also seen a slowdown, it has not been to the same extent as the diesel industry and with higher palladium loadings per vehicle required to meet the tighter emissions standards, palladium demand remains quite strong. This multi-year strong demand has made significant inroads into palladium’s above ground stock levels, with the metals supply demand market being in deficit for the last 3 years and showing no signs of going into surplus in the next few years. There could be a point in time when the major auto manufacturers succumb to paying too high a premium for an inferior metal and switch from palladium to platinum for petrol ICEs, but as this process would typically take 1 to 2 years to eventuate due to R&D and regulatory requirements, the short-term outlook for palladium remains strong.

Longer term, all the PGMs face demand headwinds with the increased market share of electric vehicles at the expense of ICE vehicles in the auto industry. But with the emergence of hybrid vehicles and zero emission hydrogen fuel cell vehicles which require larger PGM loadings, these headwinds may turn into tailwinds as these emerging technologies further develop. What won’t change is the very limited supply of all these precious metals, as ore bodies become more cost intensive and harder to find.

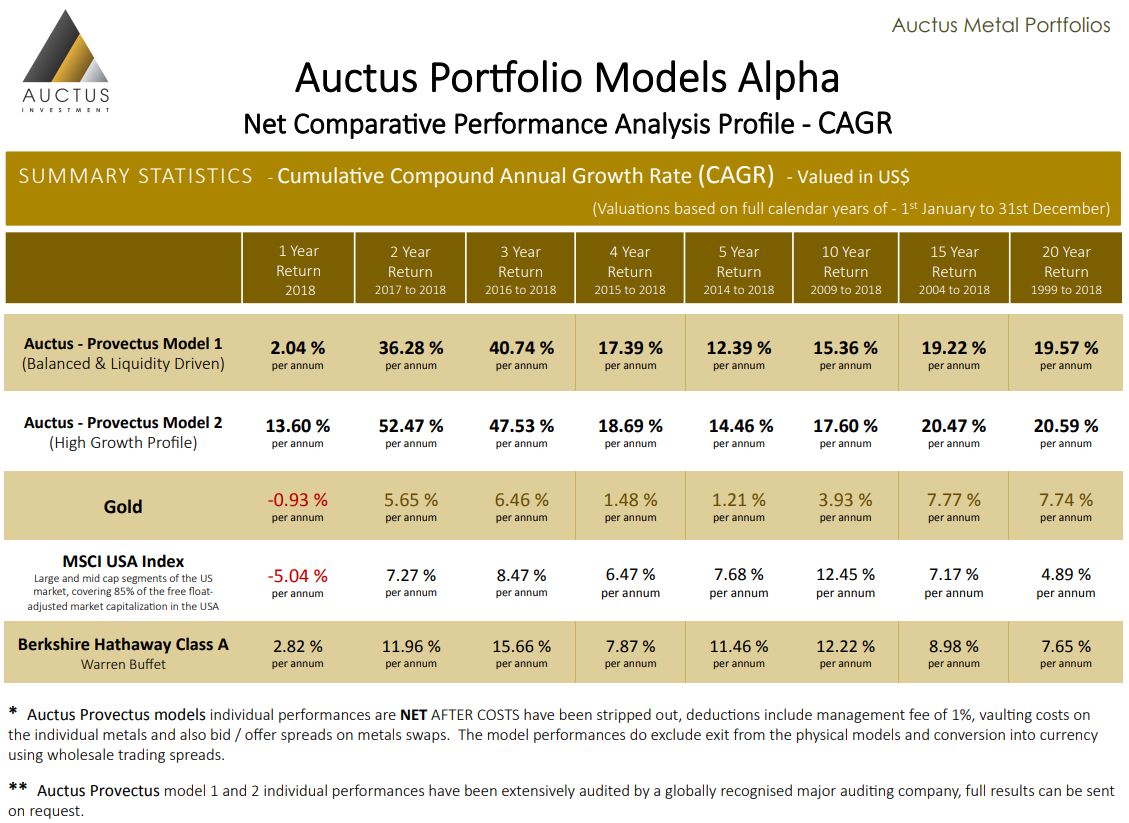

Like any successful diversified investment portfolio, it’s all about a continual balancing of potential returns with potential risk. Quantifying the appropriate exposure to these more volatile precious metals based on market conditions can significantly improve your overall precious metal investment performance. Auctus, an affiliated Singapore based company that specialises in managed physical precious metals portfolios does this very well and their fully audited long-term performance analysis results below indicate how lucrative this can be if done well by experienced precious metal market participants.

If you have any questions about palladium and how you can manage your precious metals portfolio better, please contact our sales team on 1300 618 363 or email [email protected]