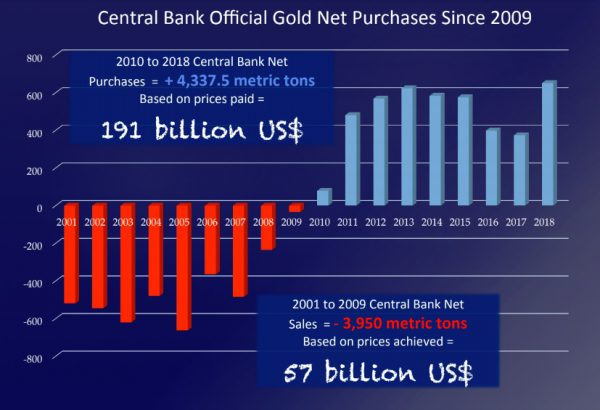

The barbarous investment relic gold is seeing spectacular official buying, sovereign central banks of emerging economies alongside China, Russia, and many other developed economies are diversifying their balance sheets into physical gold. Last year was a watershed in the size of official sovereign physical gold purchases, as central banks added an incredible 651.5 tonnes to their holdings, according to the World Gold Council (WGC). Not only is this a remarkable +74 percent change from 2017, but it’s also the most on record going back to the year 1971, when President Richard Nixon reneged on their obligations and brought an end to the Bretton Woods monetary system (gold standard).

If you want to see what is going on, I have included a single slide of my updated presentation as a pdf to this email.

The USA Federal Reserve started raising rates in December 2015 from 0.25% and the last rate rise in December 2018 raised the rates to 2.5%, effective funds rate has gone from 0.12% to 2.40% or a + 2,000% increase.

https://fred.stlouisfed.org/series/FEDFUNDS

Gold in that same time frame moved from US$ 1,064 in December 2015 to today’s level of US$ 1,315.00 or a +24% appreciation, plus gold is trading at all-time new highs in over 72 global currencies presently.

I have explained this many times to investors, and its quite incredible how many people ignore the historical facts, the greatest bull market in history in gold during the 1970’s and interest rates rose dramatically in conjunction with the rise in gold, this time however the crisis is even worse.

We are in a global debt crisis and global central banks are buying physical gold dramatically, why ? How do you reduce the burden of unviable, unsustainable debt levels without defaulting, you destroy the denominator of that debt which is currency value!

Silver demand is again forecast to outpace global supply inclusive of recycled material.

https://www.silverinstitute.org/silver-market-trends-2019/

A nice video presentation to watch in silver ….

https://www.youtube.com/watch?v=26AIReJniwc&feature=youtu.be

Another on point video for you to watch….

https://www.youtube.com/watch?v=xyIg4QFU24E&feature=youtu.be

We are watching the markets across all the metals, advising our client base across all sectors from money managers to private individuals, the underlying currents are spectacularly bullish metals over the next few years and you have to be aware of how to protect yourself and the exact diversification that needs to take place.

Founder and Partner Indigo Precious Metals