Silver and Gold Opportunity Presents itself

For the first time in 24 years, banks go long on silver in Comex Futures index

Article by David Mitchell

The deformities of our present global system are driving markets into breaking historical precedents on a regular basis these days, for example the US stock markets are now in the longest recorded bull market in recorded history (beating the 1990 to 2000 bubble), or the largest global debt bubble ever recorded seems to be setting new records day in day out.

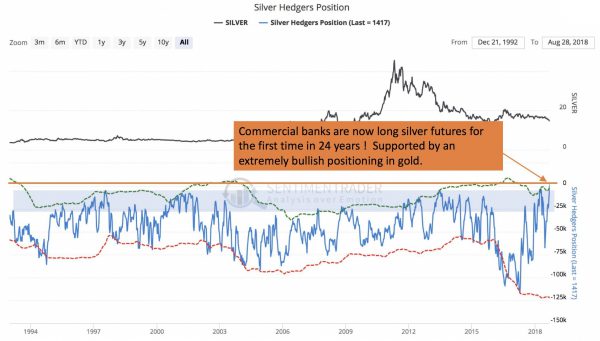

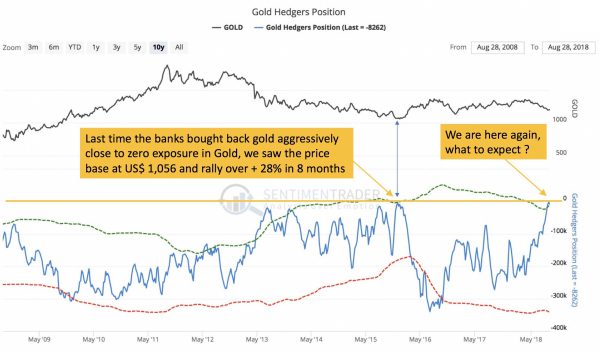

But one of the most dramatic turns is the fact that the bullion banks are now long the silver market for the very first time in the past 24 years of Comex markets. They are also in one of the most bullish trading positions in the gold market in the past decade.

Hedge funds and speculators have led the charge on shorting silver and gold and are recording historical short positions. This simply never ends well historically for the speculators; the banks are in the stronger position with the enormous power to leverage into positions (extreme low margin requirements) to simply overwhelm the speculators.

It seems they are now preparing for a historic short squeeze (higher) in gold and silver.

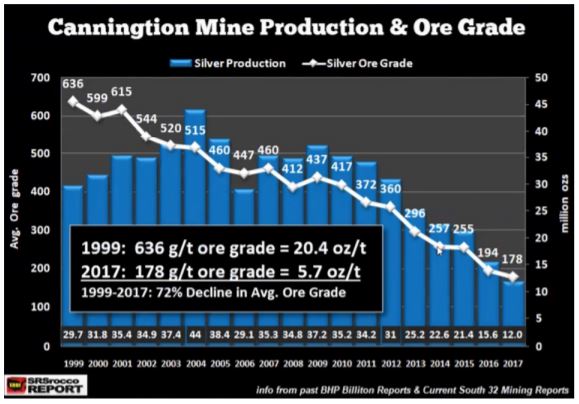

This coincides with reported falls in mine production and peak gold and silver mining, alongside the all-in-cost production of silver at much higher levels than today’s prices.

The positioning in the Silver futures market is supported by an enormously bullish gold set-up.

I am not stating the price cannot go a little lower from these levels, but this elastic band is being stretched to breaking point, at some point there is going to be an enormous price resolution to the upside.

Silver AISC – ‘All-In-Sustaining-Cost’ Production Metric Is All Important

The market generally has a rather large misconception surrounding the production costs of gold and silver. Of course, silver is produced as a by-product of gold, copper, lead and zinc mining, but more importantly, approximately 30% of global production of silver is by primary mines solely developing and producing silver and hence AISC is all important.

If the cost of production was close to common misconceptions of US$ 5 to US$ 8 globally as generally perceived then where are the massive windfall profits of these mining groups?

In fact at the lows in silver of last Qtr 2015 the AISC (all-in-sustaining-cost) for major silver producers was widely recognised close to US$ 14 globally (using analysis of balance sheet returns). This has only risen since that date, especially driven by energy costs, in December 2015 WTI Crude Oil prices were trading at US$ 35, today it is trading at close to 70 US$.

Metal mine producers are pure energy-intensive businesses, ore grades globally have fallen dramatically and hence a greater amount of tonnage of rock has to be extracted and processed, mix this with higher energy prices does not equal lower AISC !! …

Mine production is shrinking due to unsustainable ore grade falls, limited new discoveries and more importantly the fact that they cannot make positive cash flow returns due to present prices.

So you can effectively purchase investment grade physical silver cheaper than the global producers can get it out of the ground, alongside a shrinking mine supply.

How do you envision this will eventually resolve itself? VIEW LIVE PRICING

About the Author

David has nearly three decades of experience in the financial markets working for some of the world’s leading international banks.

Some of his most notable roles have been Head of Proprietary Trading, Europe and Head of Spot Trading, Asia-Pacific for HypoVereinsbank AG; Chief Dealer and Manager of the G10 Desk for HSBC; and Chief Dealer at the Forex Desk for NationsBank Group, Singapore.

David brings his expertise and energy to the role of Managing Director of Baird & Co Asia, and Founder and Non-Executive Director of Indigo Precious Metals.

IPM Group, indigopreciousmetals.com has a presence in Singapore and Malaysia and trades in physical precious metals. Its primary focus is the supply and physical delivery of investment grade precious metals directly to customers.

David is a skilled economic writer, he produces regular commentary to demonstrate his views on precious metal investing. His articles and reports are insightful, full of factual data and references and are a valuable source to assist with investment decisions. David mixes his connections, experience and analytical mind with an entertaining and explanatory writing style that is enjoyable and easy to read.

I approach my long-term trading strategies from a knowledge based on how all markets and assets classes are inexorably linked to each other within major cycle trends in capital flows.

How Gold Stackers and David Mitchell work together

The team at Gold Stackers regular communication with David Mitchell in several ways:

– David shares his views on precious metal investing with commentary, team training and regular updates about the fiscal environment, Macro Economic drivers and supply and demand scenarios affecting precious metals.

– IPM and Gold Stackers work closely in offering solutions for investors to trade and store precious metals including offshore vaulting of Palladium and Rhodium.

– David has recently been appointed Managing Director of Baird & Co Asia and hence a partner of Gold Stackers as we are an official distributor of Baird & Co in Australia.

Disclaimers : IPM Group Pte Ltd. 30 Cecil Street, #19-08 Prudential Tower, Singapore, 049712, Company Registration No: 201428070N. All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher.

The information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation – we are not financial advisors, nor do we give personalized advice.

The opinions expressed herein are those of the publisher and are subject to change without notice. It does not take into account the particular circumstances, investment objectives and needs for an investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.